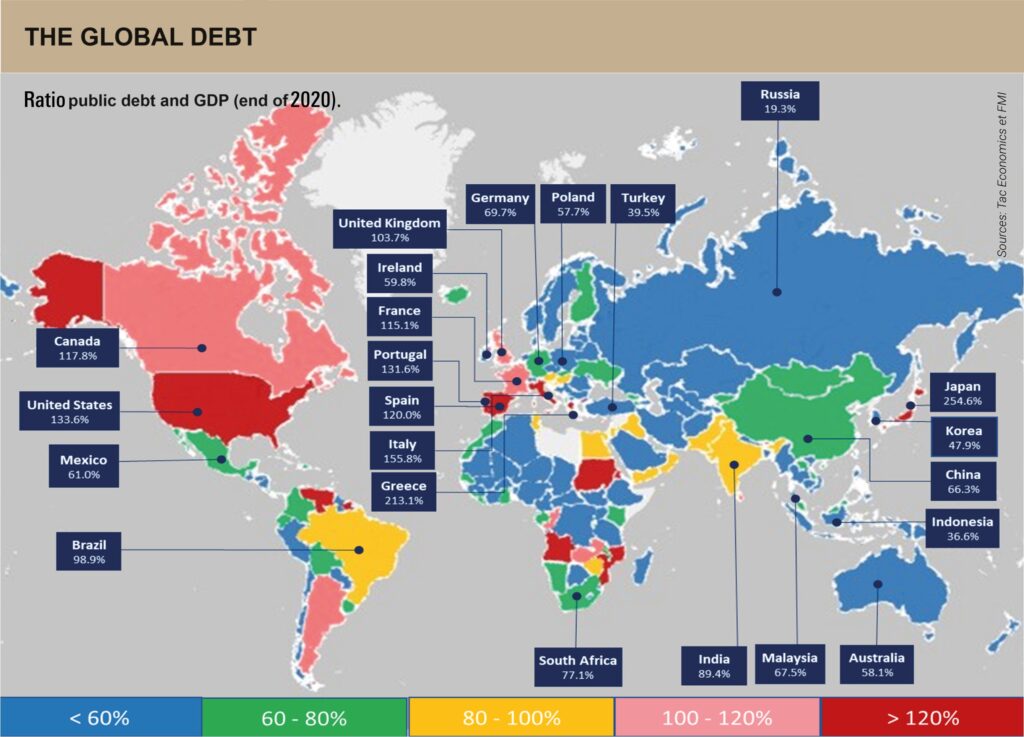

Following the collapse of Lehman Brothers in 2008, the world’s largest bankers had an emergency meeting in London, and the blocking of all global financial transactions was seriously envisaged. The bankruptcy of Lehman Brothers was largely stifled by the massive repurchase of securities and bonds by central banks, thus weakening their balance sheets. Fifteen years later, not only has the scourge not been resolved, but it has been heavily aggravated, putting the entire global economy in a chain reaction situation in the event of a new Lehman. It is difficult today to predict where the fire will start, because almost all banks are equal, be it giants like UBS, Credit Suisse, Deutsche Bank, etc., one will suffice to trigger all the others. It is only a matter of time. Their exposure to derivatives, including exotic products based on debt speculation from insolvent players, makes the situation explosive when it is discovered that some banks exceed the GDP of a country like the United States. A jungle where even traders themselves can’t get to know the real exposure. These amounts are out of balance sheet, i.e. they do not appear in the annual accounts of banks.

Now, in the event of a financial crisis, the legislator is legally entitled to block all accounts, and even all transactions, in all the countries of the European Community. In recent years, special laws have been passed in this regard.

We often hear about the guarantee of EUR 100 000 on our bank deposits. What does that really mean? For example, in France, in the event of bankruptcy of your bank, the National Guarantee Fund will compensate your bank account up to a ceiling of EUR 100,000. Obviously, if you have multiple accounts, you will benefit from a double guarantee. Only, if you look closely, the National Guarantee Fund contains only a few billion while our savings amount to trillions. At present, such a guarantee fund can actually cover only a few tens of thousands of deposits.

Each account will likely be compensated in the same amount, and for all, but the ceiling will depend entirely on the loss caused by the financial crisis. Not to mention currency devaluation and hyperinflation. In other words, this amount will be insignificant.

There are two factors to consider in the event of bankruptcy. The first concerns the amount you will have left in the event of bankruptcy of your bank. Your funds will be blocked as soon as the balance sheet deposit is announced. Following judicial liquidation or a possible redemption by a competing bank, you will recover your cash, either partially or you will lose it all. The second factor concerns the amounts that will be withdrawn from your accounts in order to repay this time the entire banking system. For example, during the Cyprus crisis in 2013, more than 40% of individuals’ savings were robbed to help the banking system.

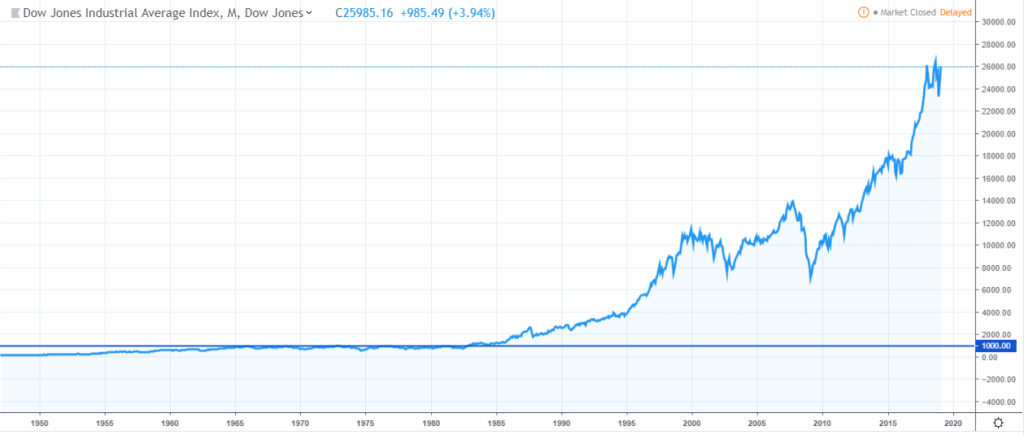

To cover losses, an appeal to savers’ deposits and funds held in life insurance (including the conventional euro fund) is highly likely, since they both represent the majority of citizens’ wealth. As for the expropriation of land, such as houses and apartments, this hypothesis is unlikely. On the other hand, the extreme increase in property tax is almost certain, forcing homeowners in difficulty to pay to sell their houses and apartments, resulting in a major real estate crisis. Indeed, the value of real estate is now largely overvalued. It is highly likely to see a re-adjustment in the near future. This applies to shares of companies whose valuation exceeds their real values. The phrase “trees never climb to the sky” is here quite representative of the situation.

As far as banks are concerned, some of them are obviously stronger than others. Their solidity is based on three main data to observe:

– on the one hand, their capital stock held in the balance sheet, i.e. the ratio that exists between equity and debt,

– on the other hand, their exposure to derivatives, as trillions of dollars are involved for each bank,

– and finally, has your bank separated its activities from deposit banking and investment banking?

> French life insurance contracts, composed on a large scale of bonds, i.e. debt, are subject, in France, to the Sapin 2 Act, which authorizes the blocking of purchases, even partial. This law was enacted to curb insurer bankruptcy in the event of panic in the stock markets. Thus, the conventional euro fund that makes up your life insurance can bear major losses on the bond market without you being able to redeem the shares from your insurer, thereby increasing the risk of a total loss of your investment.

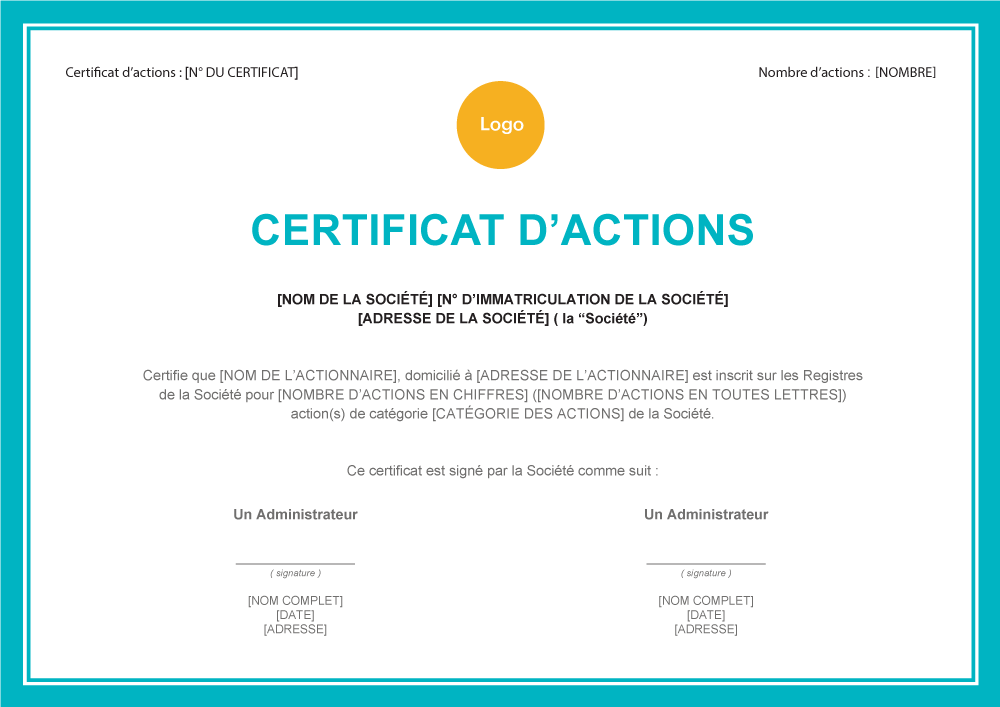

> As for your securities account, be aware that your stock broker is not infallible. In the event of bankruptcy, you risk losing all of your assets held on your account, even your corporate shares, because these are not registered in your name but in that of your broker. However, it is possible to register them under your own name and obtain a certificate of ownership. This depends on the country where your broker is located. Contact me for more details. Thus, in the event of bankruptcy of your stock broker, you will have proof that these and those shares of the company belong to you.

During our interview, we will develop a strategy tailored to your personal situation, addressing multiple points such as:

- banks to avoid and banks that offer better guarantees,

- investment in tangible values through precious metals, certain real estate and securities, see in wine and art,

- diversification, with, for example, holding bank accounts abroad, a crypto-currency portfolio, a securities portfolio,

- preparedness in the event of financial collapse.

BY BOOKING A CONSULTATION, YOU GET:

– quality advice tailored to your expectations, in compliance with the laws,

– investment advice in tangible values,

– a diversification strategy.