In terms of diversification and asset protection, there are also the offshore bank accounts.

Since the last financial crisis of 2008, many laws have been passed in Europe to legalise the blocking and seizure of funds held on bank accounts in order to replenish banks in the event of financial difficulties. In one of the Member States of the European Community, Cyprus, the government in 2013 punctuated individuals’ deposits for this specific purpose. Today, the rest of the European Union is only a step away from following the Cypriot path. In Lebanon, which is experiencing a severe economic crisis, weekly withdrawals are severely limited, sometimes forcing some savers to rob their own bank to recover their savings.

That is why placing part of its economies outside Europe is becoming a great necessity.

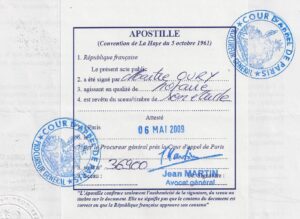

Through our network of partners, we offer you multi-currency current account opening, as well as remote securities accounts without even leaving your country. Thanks to the documents that we will provide you, which will be legalized and apostillated in your country of origin and then sent by post, you will receive in return, a multi-currency bank card, your access codes to the online banking service (usable both on your phone and on your computer), a detailed procedure in your language of origin to give you the opportunity to quickly and fully use the service of remote banking. You will have the choice of the country in which you will implement your bank account, with formulas ranging from the conventional account to the private bank.

When opening an offshore bank account, the important thing is to report it to the tax authorities. Why?

Many websites on the internet offer you a discrete opening. In an increasingly digital world where information is becoming transparent, finding yourself with an undeclared bank account can become problematic because you might not know how to use the funds at risk of attracting the attention of your country’s tax authorities. With the latest automatic exchange of information governing tax transparency (AEOI), which almost all countries in the world have attached, the benefit/risk ratio is not profitable.

Nevertheless, in order to avoid double taxation, many countries have signed bilateral agreements, allowing taxation to be carried out only in one country.

Another important point concerns the potential blocking of your payment method by your bank in case of suspected theft or hacking. Indeed, a lot of fraudulent uses are taking place. When a suspicious transaction occurs, the bank’s security system blocks the card. The bank may block your card for example because of an operation carried out in a country where the customer is not supposed to be by his habits, an attempt to withdraw from a ticket dealer starting with large sums, purchases made on certain websites… You find yourself on vacation without a bank card can quickly become a calvary. Having multiple bank cards from different domestic and foreign banks offers you an excellent guarantee against these points. In all these years of travel, I have often been told that one withdrawal or payment with one card can very well be done while another does not, and this for unexplained reasons. It’s better to cover up against this kind of misfortune. I can give you simple methods to avoid finding yourself with a card hacked or blocked.

Depending on your banks, you can also jongle with withdrawals, payments and exchange fees. For example, an online bank will offer you low fees for payments abroad, whereas it will be a good idea to avoid using a local bank card.

BY OPENING AN OFFSHORE BANK ACCOUNT YOU GET:

– a bank account in a robust jurisdiction,

– a multi-currency bank card,

– access to remote banking with a procedure in your native language,

– request our services for any other interventions with the bank (supplementary).